Mortgage After Marriage: The essential guide to home financing for newlyweds

We created the easiest process to request and submit mortgage info!

Start with our online application

book a call with one of our experienced mortgage nerds

Mortgage After Marriage: The essential guide to home financing for newlyweds

Trust us: during the home buying process, you DO NOT want to…

In a matter of days we were approved for an FHA loan

Luckily we found Julie

I’ve used Julie’s services twice

Julie was a breath of fresh air. She’s smart, experienced, easy to communicate with

My hubby and I worked with Julie to purchase our first home and it was awesome

THANK YOU JULIE AND TEAM for everything!

Julie is a ROCKSTAR!!!

CONTACT

CONNECT

Trust us: during the home buying process, you DO NOT want to find out your ride or die has their credit on life support.

So we created a guide so you can achieve that goal of home ownership while keeping your relationship in tact.

first comes love,

then comes marriage,

then comes a mortgage with an unnecessarily high interest rate…because hubby forgot to return his cable box in 2016

The Good, Bad, and the Straight Up F’ugly

Now without fear of judgement (and annulment), close your eyes, and reveal your true selves (aka your financials) to your significant other:

- Credit score

- Debt

- Bankruptcies

- Foreclosures

- Child support

- Financial Assets & Income

- Did you know that FICO is slang for “cool” in Italian? So, on a scale of 300 to 850, how, um, cool are ya?

- You know I love everything about you. SO how much debt should I plan to love?

- Start an innocent game of “I have never”. Mid-way, say “I have never been bankrupt”. A bit later…”I have never foreclosed on a property”

- You got any kids? Because I could turn into the Wicked Stepmother real quick depending on how much the child support payments are.

Reality Check: if he drops you because of your credit score, it wasn’t meant to be, ladies & gents. Hiding away those kids on the other hand…

Ok, now that you’ve revealed your FICO, BKs, Foreclosures, and closet children, it’s time to get your spending habits out in the open.

Start with a deep dive into your bank and credit card accounts. Most banks will group monthly and annual expenses into categories like rent/mortgage, travel, meals, entertainment, etc. Make sure to rely on the actual spending records vs each others’ recollections…since your imagination will conveniently fudge any numbers it can, to keep your ego in tact.

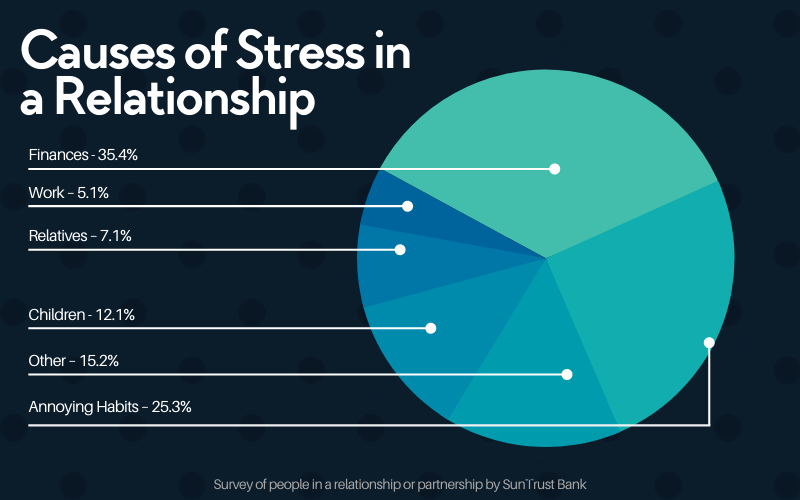

Don’t believe me? The SunTrust survey found that people are more than twice as likely to say they are the “saver” and their partner is the “spender”.

That means there are a lot of people out there whose imaginations are cooking the books. Laying these cards out on the table will avoid big surprises later…and will also prep you two for some important decisions like:

- Are we doing a joint checking and/or savings accounts or keeping accounts separate?

- Are we gonna be single income or dual income? Will that change when we have kids? Sidenote: DINK* envy is real!

*DINK stands for Dual Income No Kids

The Big Questions to Prepare Newlyweds for Homeownership

- Where are we gonna live and what/who should it be near?

- Are we planning to buy vs rent?

- Do we need a home big enough for kids? This one should be obvious by now, but you’d be surprised…

- Are we city slickers, country bumpkins, or suburban soccer mom and/or dads, property moguls, or digital nomads?

Lenders will use the lowest mid credit score of all borrowers. The “mid credit score” is the middle score returned by the three credit score bureaus: Equifax, Experian and TransUnion.

No but in some cases it’s advantages especially if you want to avoid paying mortgage insurance (PMI).

If you can qualify with only one person on the loan, there aren’t many scenarios when it actually makes sense to have both people on the loan IF only one person can qualify.

Yes, they can still be on title for the home. If you don’t want them on title, they’d need to sign a quit-claim deed (even if they aren’t on the loan).

Now with your due diligence out of the way (presuming you are planning to purchase a home) it’s time to house hunt. As you’ll see below, you may want to start some of these steps before getting hitched. Just keep in mind, there are some relationship landmines ahead.

Get a Head Start on Planning Your First Forever Home!

Some would call this the “fun part”. This is where you take your dream home off your vision board and begin to realize it. Btw if you find that you want drastically different things in that dream home, the fun doesn’t last for long…but it’s still important to know!

- Where?

- How much space?

- What condition?

- What features?

- How big of a backyard is needed so the in-laws have a place to sleep?

- How dare you make my mamma sleep outside?!

One way to get these questions answered, is to make a list of the features that you need vs want in your home. If you want to live dangerously, make your lists independently and review each others answers. Welcome to your first argument about buying a home!

Want a pro tip?

Ask a pro! Involving a local realtor is a great way to navigate these criteria within the context of the local property market. They are also a good third party to settle disagreements in your needs & wants criteria list. These answers will inform the dreaded question: how much is it all gonna cost??! Disclaimer: the fun part is now definitely over. As a consolation prize though, you can now start referring to your significant other by a new pet name, co-borrower. When it comes to cost, couples often disagree on how much money they should spend on a home. We’ll get further into it in the next section, but a rule of thumb that financial advisors use is that your monthly mortgage payments should be no more than 25% of your take-home pay aka your post tax monthly income.

Get a Head start on planning TO AFFORD your first forever home

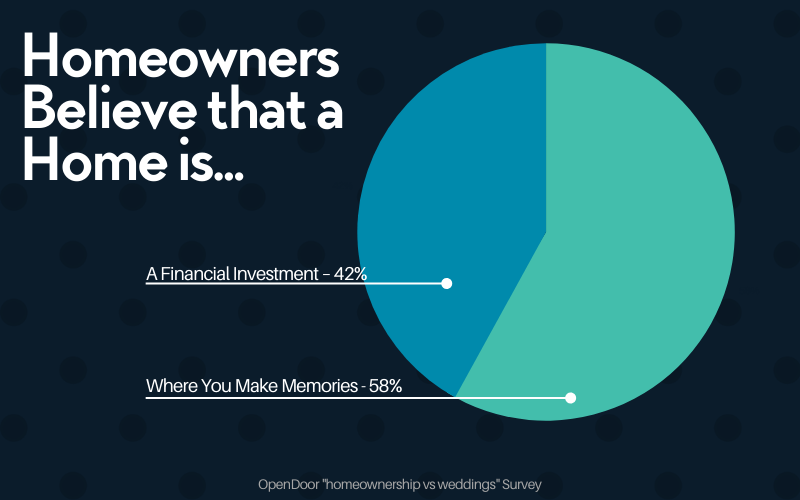

Talking to a mortgage pro early on is a good way to get an understanding of where you need to be financially and credit-wise when the time comes to buy together. After all, surprises are rarely good when it comes to home buying. Also don’t forget – just because you can get approved for a mortgage up to a certain home purchase price, doesn’t mean you should! You need to do what’s comfortable for BOTH of you. Remember how high finances ranked in terms of relationship stressors? So if you want to prolong that honeymoon glow for as long as possible, minimize “monthly payment” stress as much as possible. Also keep in mind you don’t want to actually get pre-approved until you are seriously looking for a home because that pre-approval won’t last forever. Once it expires, a credit check is needed for a new pre-approval…and repetitive hard credit checks aren’t good for your score.

Work on your credit together

Speaking of credit…credit scores have a heavy influence on interest rate. It also fluctuates and plenty can be done to improve it especially if you’ve got time. Find a credit repair specialist if either of you have scores lower than 650. They ain’t free, but probably the savings from a lower interest rate are well worth it in almost every situation.

Be real about whether you are buying a forever home or a stepping stone

Now you know what kind of home you want AND what you will be able to afford. It’s time for the reality check: do they match up? There’s no shame in admitting your first home as a married couple may not be the forever home. Make the best housing decision for your finances and just keep improving your situation so you can eventually get where you really want to be. After all it’s not a forever home if you can’t afford it forever. So rent for a while if you need to…or buy something that may not meet all the “want” criteria you listed. Another option is to buy something that has rental income potential like a getting a duplex or even taking in a roommate. It’s actually more common than you’d think especially in the pricier areas. A Trulia study found that every $100K increase in median home value in metro areas corresponds with a 0.25% increase in the number of married couples with roommates…and adult children don’t count as roommates btw.

Don’t get discouraged

There are some tough topics to navigate in getting that first home after marriage. Even once you’ve got it, you’re going to have to live with that payment for years. So stay disciplined when it comes to those splurges and always remember that you can get your heart shaped chocolate for up to 75% off if you just wait until February 15th. Just leave me some of the dark chocolates or else!

PS Check out our simple eval process where you can choose whether you want to: get real rates specific for your scenario (beware of teaser rates!), see how much home you can afford, get pre-approved, or quickly submit your contact info so we can get back in touch.